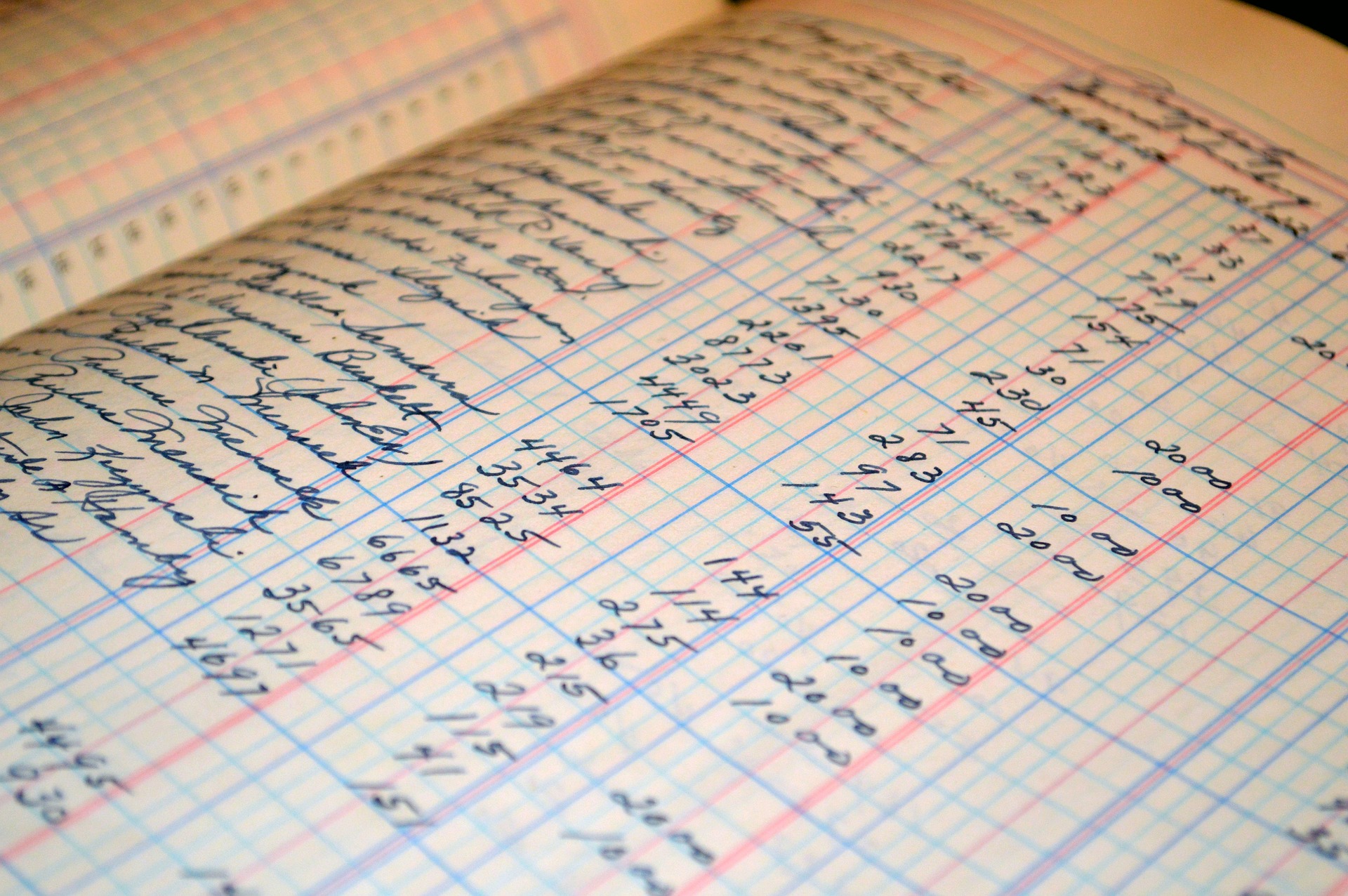

Bookkeeping service

Accounting services

- Simplex accounting for practitioners, crafts businesses, and free occupations

- Double accounting for medical institutions, ltd. and simple ltd.

- Consultation services

Earnings and personnel records

- Personnel registration with pension and health insurance

- Wages accounting in accordance with the latest legislation (Labor law, collective agreement, book of regulations)

- Fill-in Statement on receipt, income tax, local income tax and compulsory insurance contributions (known as JOPPD Statement) and deliver the statement to the Tax Department via their Internet service e-porezna

- Listing of annual wages report (IP report) for each employee consistent with the Law

- Fill-in statistical form RAD-1G

- Accounting traveling orders, local drive (keeping evidence of traveling orders)

Accounting specifics for free-lance occupations and craft businesses

- Receipt and spending book (KPI)

- Fixed asset book with amortization accounting

- VAT accounting

- Incoming invoice book (UR-a)

- Outgoing invoice book (IR-a)

- Claim and liability book

- Annual income tax return (DOH form) for self-employed occupations and craft business

- Account of Chamber and other contribution

Specificity of medical institutions, simple ltd. and ltd. books

- Incoming invoice book (UR-a)

- Outgoing invoice book (IR-a)

- VAT accounting as well as delivering the tax statement to the Tax Department via their Internet service e-porezna

- Bank statements and cash accounting

- Fixed assets list with depreciation accounting and inventory

- Listing of Inventory lists

- Entering annual statements for medical institutions (PR-RAS, Balance of accounts, Liabilities)

- Completing the GFI form for statistical and public publication (LTDS)

- Profit loss account

- Balance of account

- Profit tax on PD form

- Notes for financial statements

- Chamber contribution accounting

- Other statistical and public proclamation necessities